2024 | Empowering Mexico's Pawnshop Economy for Financial Inclusion

Overview

Role

UX/UI Designer

Team

Product team: Five UX/UI Designers (including me), and two Product Managers.

Timeline

1.8 years

Tools Used

Figma, Maze, Figjam, Hotjar

Ataskate is a revolutionary proposal management tool tailored for pawnshops in Mexico. In recent years, these establishments have become essential financial resources for the lower and middle classes, offering a viable alternative to traditional bank loans that often remain out of reach. Pawnshops provide loans secured by personal items as collateral. If a borrower defaults, the pawnshop sells the collateral to recoup the loan amount. This model has fostered a dynamic and adaptive economy in Latin America, where pawnshops are pivotal in bridging significant financial gaps.

The Challenge

Ataskate faces several key challenges, including:

Regulatory Adaptation: Tailoring loan terms to comply with diverse regional regulations.

Balancing Automation and Human Interaction: Automating processes while maintaining crucial human connections.

Accurate Cycle Representation: Effectively reflecting both pawn and commercial cycles in the tool’s functionality.

Legal Compliance: Ensuring adherence to legal standards across various regions.

User-Friendliness: Designing for a vernacular economy, making the tool intuitive for non-technical users, and accommodating specific pawnshop requirements, such as collateral tracking.

Scalability: Developing a solution that can support larger operations and evolve with industry demands.

The approach

To create a solution-focused tool like Ataskate, we undertook a comprehensive approach to understand pawnshop operations within Mexico's alternative financial ecosystem. This included:

Mapping the Pawn Cycle: Analyzing the journey from contract signing to loan defaults to empower pawnshop owners in addressing market challenges and enhancing financial inclusion for underserved communities.

Internal User Interviews: Gathering insights from pawnshop owners and employees regarding their daily tasks, pain points, and specific needs.

Contextual Inquiry: Observing pawnshop operations in real time to gain a deeper understanding of workflows.

Customer Journey Mapping: Identifying touch points, pain points, and opportunities for improvement throughout the pawn and commercial cycles.

Task Analysis: Breaking down routine operations to discover automation opportunities and streamline workflows.

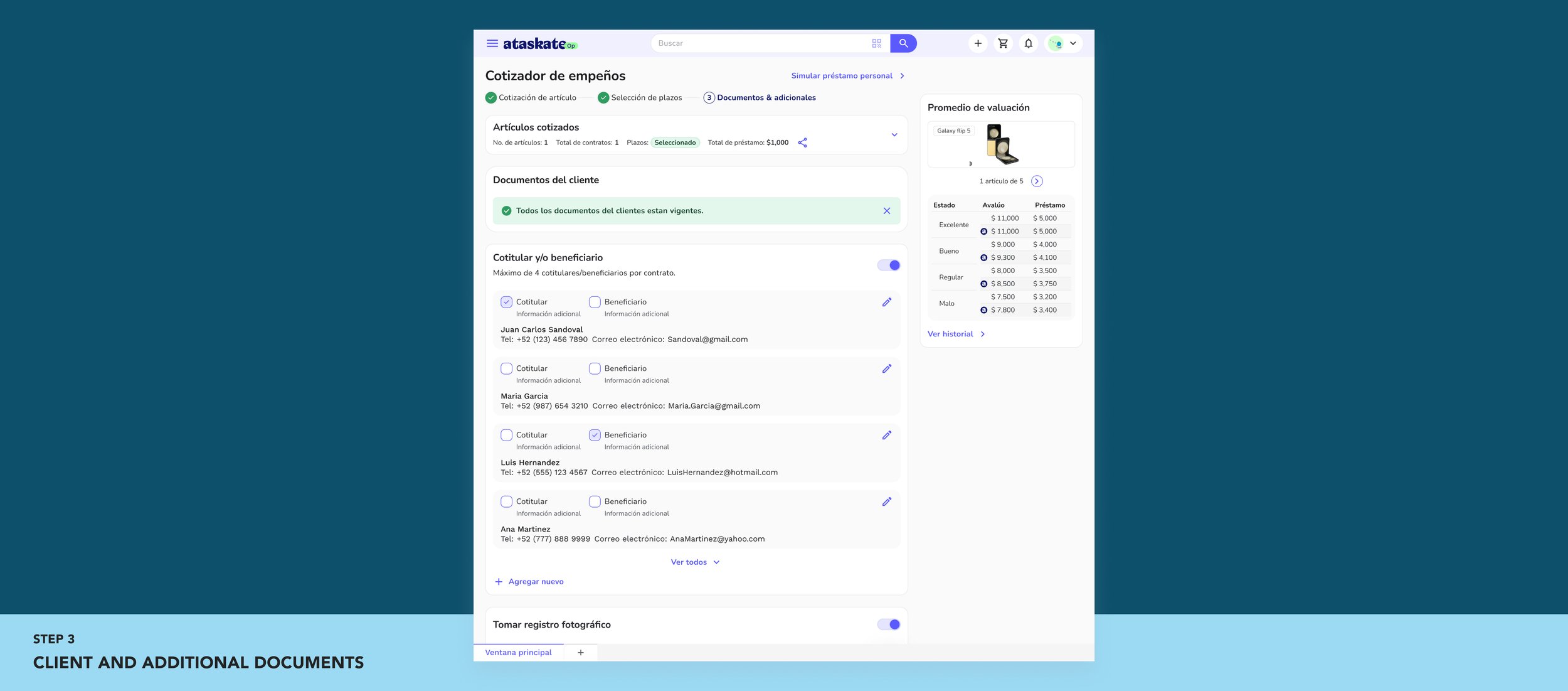

Wire framing and Prototyping: Creating low-fidelity wireframes and high-fidelity prototypes to visualize the tool’s interface and functionality before development.

Competitive Analysis: Evaluating similar tools and platforms in the pawnshop and financial services space to identify strengths, weaknesses, and potential differentiation areas.

The Solutions

We are creating an adaptable tool to various loan structures that automate key processes like inventory management and loan tracking, and provide a clear workflow for approvals, payments, and collateral sales. It complies with regional legal frameworks, offers real-time reporting, and features a user-friendly interface. It is tailored to manage collateral appraisals and resale. We are aiming to build it on a scalable infrastructure, the tool supports growing operations with expanded reporting and customer management capabilities.